LaTeX templates and examples — Math

Seneste

CT problem set for undergraduate Medical Physics course.

The problems on HW 7 all lined up and ready for proofs!

Prova da expressão da norma utilizando o teorema de pitágoras.

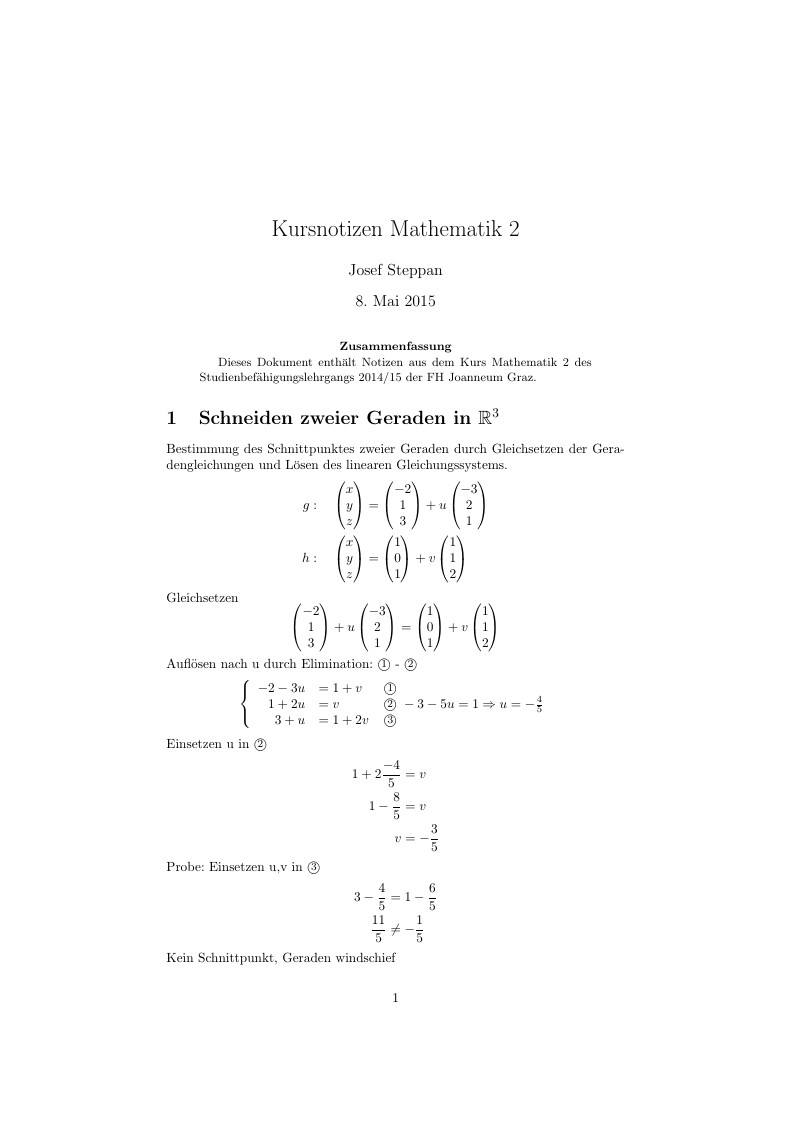

Dieses Dokument enthält Notizen aus dem Kurs Mathematik 2 des Studienbefähigungslehrgangs 2014/15 der FH Joanneum Graz.

This is the solutions document for a mock AMC10.

Assignment Template for CS330 - Introduction to Operating Systems

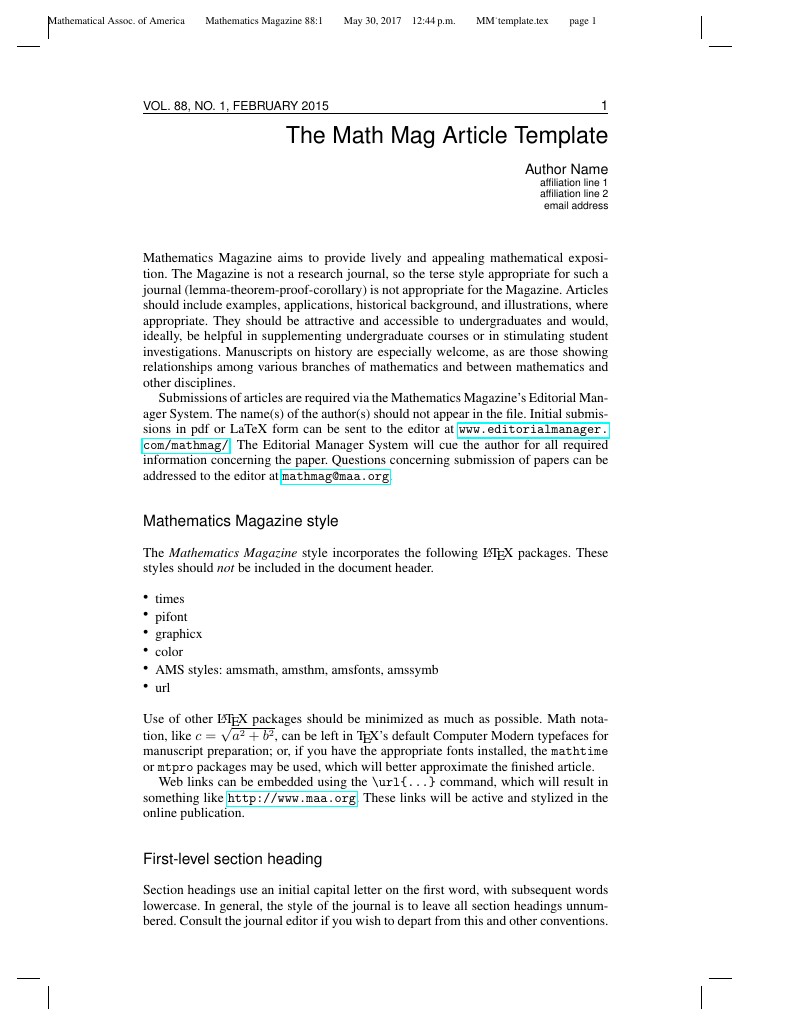

Downloaded from Mathematics Magazine's website. Mathematics Magazine offers lively, readable, and appealing exposition on a wide range of mathematical topics.

A template to help students at the University of Bristol with their Mathematical Investigations projects

Neste artigo apresentamos a segunda parte do nosso trabalho em Modelagem 3

\begin

Discover why over 25 million people worldwide trust Overleaf with their work.